How To Deal With Financial Anxiety.

Published on by FulusAfrica Team

“A big part of financial freedom is having your heart and mind free from worry about the what-ifs of life” - Suze Orman

Chances are you have experienced financial anxiety at some point in your life. The frustration of worrying about money when your income is stretched thin can affect your mental well-being.

Four Successful Ways to Manage Finances in 2025

Master your finances in 2025 with these four proven strategies Learn how to budget save invest and plan for longterm financial success

Read More →If you are an African working in the Middle East, I'm sure you can relate to the stress associated with making money, spending it, saving it, and investing it.

The result is that you may develop a negative relationship with money.

Economic uncertainty is a common struggle even for those of us with jobs. While your income may cover some of your financial obligations, your responsibilities might outweigh your income, leading to stress and anxiety.

Not to mention the obligatory black tax that haunts most Africans requiring them to provide for their immediate and extended family as well.

In this article, we will look at the impact of financial anxiety and discuss ways you can deal with money Stress.

What is Financial Anxiety?

This is the constant worry about money—whether it’s about paying bills, covering emergencies, or being unable to save for the future.

From the Gulf to Kenya: A Guide to Managing Finances During Your Return

Returning from the Gulf to Kenya Discover a comprehensive guide to managing your finances budgeting and planning for a smooth transition home

Read More →For migrant workers, these worries are magnified due to their unique circumstances: the pressure of paying debts, sending money home, and in some cases a lack of social support.

What Causes Financial Anxiety And Stress?

-

Pressure to Send Money Home

Migrant workers, particularly from Africa, often have large families relying on their remittances. The pressure to send money home regularly creates constant financial stress.

This is also known as black tax and refers to the money that one feels obligated to send home to support their extended families.

Any delay or reduction in income due to illness, job loss, or salary cuts can trigger a financial crisis for you and your family.

The issue can be worsened by dishonest employers and agencies who withhold pay making it difficult to support those you love.

-

Uncertain Job Security

Many migrant workers in the Middle East have contractual jobs with limited protection or guarantees. Changes in local economies, wars (e.g. Lebanon), company layoffs, abusive employers, or contract disputes can put jobs at risk.

This amplifies financial anxiety, as workers fear losing their primary source of income.

-

Debt and Loans

Many migrant workers take out loans to pay recruitment fees or travel expenses to secure jobs abroad. Repaying these loans can cause financial strain and result in financial anxiety.

Additionally, families back home might incur debt faster than you can pay it off. Things like medical expenses and school fees can cause loved ones to borrow money you are expected to pay back on their behalf.

How To Deal With Financial Anxiety

-

Create a Financial Plan

One of the most effective ways to tackle financial anxiety is to create a solid plan. Start by budgeting your income and separating necessary expenses (such as housing and food) from non-essential spending (such as entertainment and travel).

Mental Health Awareness for African Migrant Workers in The Middle East

Highlighting mental health awareness for African migrant workers in the Middle East Explore challenges support systems and the importance of mental wellbeing

Read More →A clear plan will help you prioritise your financial responsibilities, including remittances, savings, and debt repayment.

-

Build an Emergency Fund

An emergency fund is a crucial safety net, especially if you lack job security.

Regularly setting aside a small portion of income can provide a cushion for unexpected expenses like medical bills, flight tickets, or periods of unemployment.

This buffer can reduce the stress of unforeseen financial events.

-

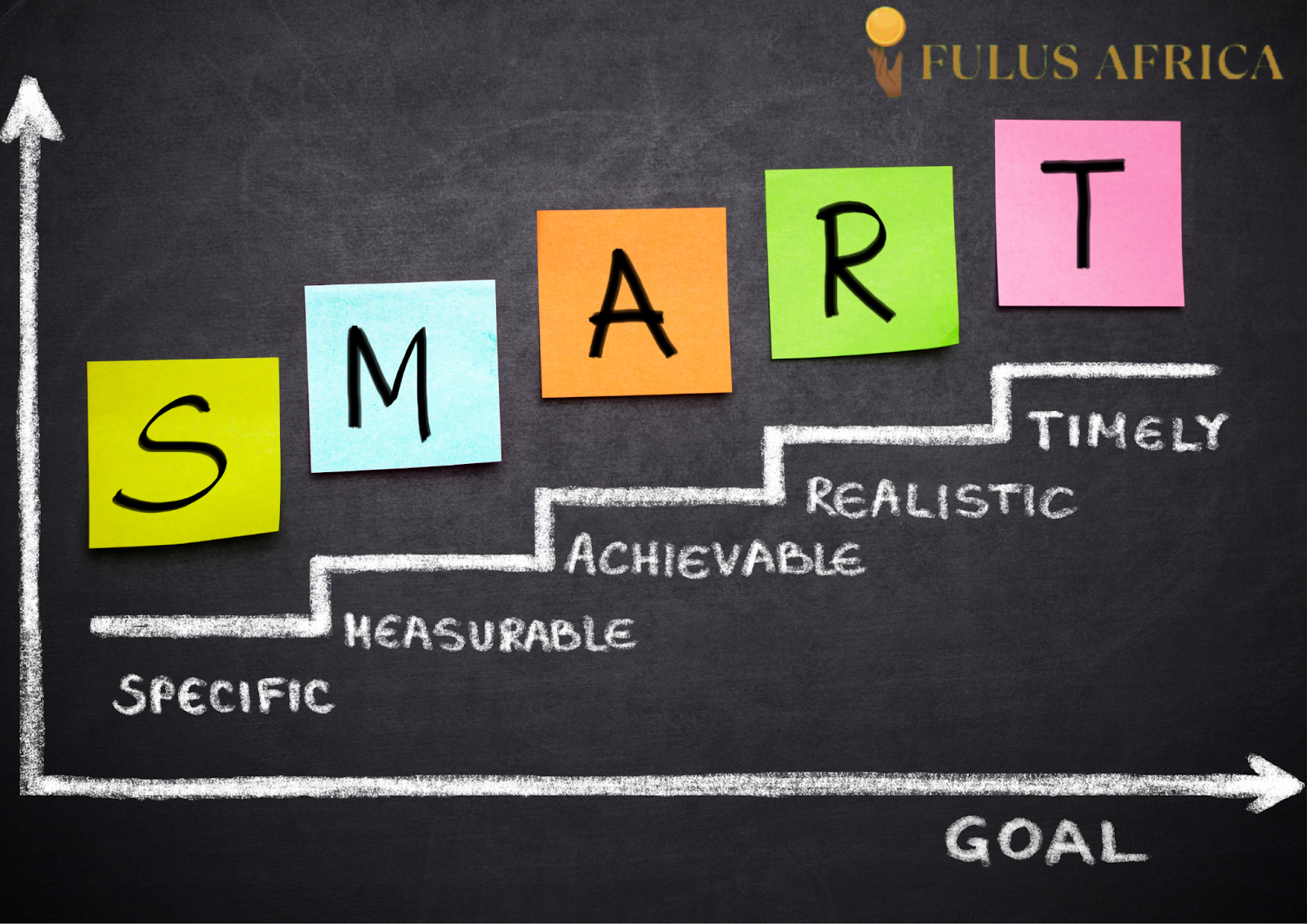

Seek Financial Education

Financial literacy can also help you deal with financial difficulties. Learning basic money management skills, such as budgeting, saving, and investing, can empower you to make better financial decisions.

Employers, community groups, or online platforms like Fulus Africa can offer workshops or resources that teach you financial skills.

-

Prioritise Debt Repayment

If you have taken loans to secure jobs or move abroad, prioritising debt repayment is essential. Paying off loans as quickly as possible can free up income for other uses and reduce ongoing financial worry. Workers should focus on paying down high-interest debts first and avoid taking on new debts whenever possible (this includes family back home).

-

Invest in Long-Term Savings

Though the immediate pressure to send money home can be overwhelming, you should also consider your long-term financial security. Investing in savings or retirement accounts ensures that you will have financial stability in the future, even when your working years are over.

Money Management: A Beginner’s Guide to Budgeting Success

Master the art of budgeting with this beginners guide to money management Learn practical tips to take control of your finances and achieve financial success

Read More →Take Charge Of Your Money.

Financial anxiety is a harsh reality for many migrant workers, but it doesn’t have to be overwhelming. The key is to develop proper financial habits like learning how to budget, seeking financial education, and prioritising long-term savings and investments. With time, you can manage your finances with more confidence.

No comments yet.